.

Some funny things have been going on in the world commodity and stock markets over the last week or so. By using the perspective of the Big Dustup Index Fund (BDUIF), we can get some insight that otherwise is not immediately apparent.

First of all, the basic events:

- The Greek Sovereign Debt Crisis looked bad, but has been been mitigated, or at least pushed into the future using moneys and guarantees that came mostly from Germany

- Oil has dropped significantly

- Gold and other precious metals have increased significantly

- World stock markets declined, then crashed, then almost immediately recovered

Remember that the intent of the BDUIF is to allow investment in "crisis" gold and oil, while mitigating the risks of "normal" economic fluctuations of the prices. The strategy is to follow the average of two ratios: the price of oil to the Dow Jones Industrial Average (DJIA), and the price of gold to the DJIA. It does this with leveraged stock market short ETFs, leveraged investment in gold ETFs, and non-leveraged investment in oil ETFs.

When oil and gold do better than the stock market, the BDUIF makes money. If oil and gold do well and the market goes down, the BDUIF makes a lot of money. The inverse is of course also true.

Let's look at the latest BDUIF chart from 12 May:

As you can see, the BDUIF has tracked the average of the two ratios pretty well until recently. The recent decline of the BDUIF from the average was mostly due to the fact that I biased the BDUIF to be heavily short European equities, so it was actually more closely following the ratios to the DAX rather than the DJIA. When the DAX recovered following the Greek bailout announcement (and I did not get out of the shorts fast enough), the BDUIF took a step downward from the light blue line.

But aside from that error, the BDUIF has done fairly well when measured against its goals.

It is clear that a sea change has occurred in both equity and commodity markets. I based the BDUIF on the fact that oil and gold were tied to the stock market; all are indicators of economic activity. I had been hoping for a "break" where gold and oil go up due to a crisis in the Mideast, for example, with the stock market falling. What we have is oil breaking the wrong way, gold breaking the right way, and the market continuing to increase or stay reasonably stable.

Regardless, the relationship between oil, gold, and stocks has changed dramatically. It remains to be seen if this will continue or not.

Here is what I think:

Oil: While inventories remain high, there was no fundamental reason for the decline. The spill in the gulf should have driven prices up -- and did for a short time. The tensions in the Mideast seem lessened right now, mostly because there is a lot of other news items that are taking up air time. But the big oil traders are savvy people -- much more experienced than the typical stock market participant. Low oil prices likely mean that someone thinks that demand is going down, i.e. the economy is contracting. I have noticed that moves in oil often signal future moves in stocks. If so, stocks will be going down soon -- or oil will begin a recovery. So I am hopeful that the BDUIF as presently constituted (I have added more oil to it at these low prices) will do reasonably well.

Gold: The Greek bailout has greatly increased the demand for gold. In Germany, coin dealers are running out of product. Large investors are loading up too. The Germans remember Weimar, and the hyperinflation of the 1930's. They believe Germany's deficit-spending to help Greece is highly dangerous. They expect Greece will need more help, and will eventually default anyway. Spending is the new contagion. First it was the US bailing out companies that were too big to fail. Now Europe is bailing out countries that are too big to fail. With truly astronomical deficits going forward, it is likely that there will be a world-wide sovereign debt crisis in the next 5 years. If so, gold will be the only thing of value --except for maybe canned food and land. So the rise in gold to record highs is another indicator showing trouble ahead. It is particularly bad since it is occurring even in the face of the dollar rising with respect to other currencies.

Stocks. The stock market is doing OK, but I see it as lagging gold and oil moves. The world is a mess. The naturally pessimistic oil and gold traders see it, but the stock market traders don't want to even hear about it. They actually have good reason to be optimistic since revenues and profits signal a recovery. But what happens when the Fed takes away the stimulus? What happens if they keep the stimulus and the unprecedented deficit spending causes inflation -- or more likely stagflation?

I recently took advantage of the gold runup and the oil decline to move more of the BDUIF to oil from gold. The short positions were causing problems, so I reduced them a little.

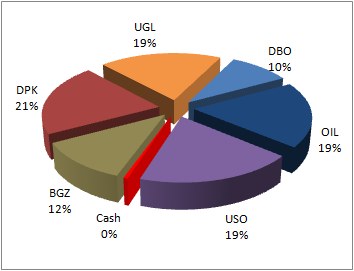

Here is the current BDUIF makeup, which heavily favors oil. I plan to reassess this on Friday, and potentially reduce the oil holdings, maybe add to the shorts, and maybe add gold if it goes down.

.

_pirate_skiff_after_being_destroyed_by_Portland's_guns.jpg)