.

Note: Charts have been updated with Friday's closing prices (5 March 2010).The Big Dustup Index Fund (BDUIF) has been performing fairly well over the last two weeks, meeting expectations. The Fund is based on oil and gold, and is designed to follow the ratio of oil and gold to the general US stock market, going up when oil and gold diverge positively from the market. It is particularly tuned to react to troubles in the Mideast and, to a lesser extent, inflation. General economic ups and downs are automatically damped out, and should not effect the Fund very much. Thus, the downside risk of investing in oil and gold is somewhat mitigated, since changes in commodity prices that follow the stock market are counteracted. For details on how this is possible, and why it may be advantageous, see my previous post.

Once again I must advise caution: If you want to make a similar investment, don’t take my word for it. Do some research and figure out if I am really making sense or not. I am not an investment counselor, and this is not intended to be advice in any way.

Recent Performance

In the following, we compare the performance of the Fund since inception on 4 February to three baselines: the daily spot price of West Texas Intermediate Sweet Light Crude Oil at Cushing, Oklahoma (WTI Cushing), the daily London Afternoon Gold Fix (London Au), and the daily closing Dow Jones Industrial Average (DJIA). We also compare the performance of the Fund to the ratio of WTI Cushing to the DJIA, and to the ratio of London Au to the DJIA, since those measures are what the Fund is intended to track. (Note: I should probably use the S&P 500 instead of the DJIA as a broader indicator of the market, but the difference is slight.)

The above chart shows overall performance of the Fund, compared to WTI Cushing, London Au, and DJIA, all normalized to 1000 at Fund inception.

Remember that the goal of the Fund is to do nothing if the gain or loss in oil and gold simply follow the DJIA.

Thus if there are no world "events", the Fund should stay at 1000. The increase seen in the Fund is due to the over-performance of oil prices compared to the DJIA, likely due to increased Mideast tensions. This is shown more easily in the next chart.

The above chart shows that the Fund is tracking the arithmetic average of the two ratios (oil to DJIA, and gold to DJIA) very well. The Fund is performing as designed. Gold however is not performing. More on that later.

Recent Changes to Improve Performance

Although the ratio of oil to the stock market has been increasing, BDUIF performance has been somewhat hindered by the fact that gold vs. DJIA is not going up in response to tensions, and by the fact that over the last two weeks, I had a significant portion of the Fund in Direxion's FAZ which is a triple bear on the Russell 1000 Financial Index. That index has outperformed the DJIA, unfortunately.

Previous BDUIF Holdings (3 March 2010)

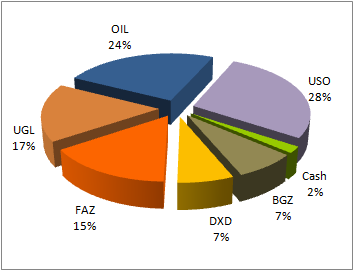

Current BDUIF Holdings (4 March 2010)

Thus the negative market hedge position now consists of two triple bear Direxion ETF's, BGZ and DPK, which together represent 19% of the Fund. Their 3x nature gives them a leverage much greater than their percentage would otherwise imply, and allow a much larger stake in oil and gold. However, over periods of time longer than a day, the BGZ and DPK ETF's are not well-behaved since they use a odd variety of financial instruments to attempt to track three times the inverse movement of their underlying indices. Holding them a long time is not recommended, and typically results in an underperformance from what one would otherwise expect. Appropriate management involves buying and selling on error trends, which is a real pain, and fraught with its own risks.

With the inclusion of DPK, the hedge position has become a little bit of a play on the Greece/Spain/Portugal/UK and all-of-Europe troubles. If the BDUIF were a tightly controlled fund, managed by rules, the managers would likely not be allowed to do this, but hey, I can do whatever I want. It is important to note though that my similar divergent venture into FAZ was a bust.

I also increased my holdings a few percent in UGL (2x gold bull), and moved a small but significant portion of my USO holding into Powershares DBO (1x oil bull). By moving into DBO, I am attempting to partially counteract roll-yield losses caused by contango that are sustained by OIL and USO due to their forced buys of next month futures immediately when their this-month futures contracts expire. DBO has a more flexible approach to futures roll, which allows their managers to roll to whatever futures contract generates the best possible "implied roll yield." Thus, they are able "to potentially maximize the roll benefits in backwardated markets and minimize the losses from rolling in contangoed markets," according to their statements. The downside is that the futures are then spread out over time, and may not react as positively as next-month oil futures to Mideast tensions/war.

Additionally, I moved a small amount out of the Fund into another investment that I wanted to chase. This marks the second time I have removed money from the Fund. The total amount removed since inception of the BDUIF on 4 Feb has been approximately 5%. All data has been corrected for these removals so that they do not impact the statistics. In other words, looking at the charts etc., it has been made to appear that the money was removed before inception.

The Problem with Gold

The basic premise that gold prices compared to the DJIA would go up following a Mideast event has always been suspect to me, and is even more suspect after the large gains in the oil to DJIA ratio with essentially zero gains in the gold to DJIA ratio, in the face of increasing Mideast tensions in the last month.

This would argue for the reduction of my UGL holding, especially since it has a 2x leverage. I will consider this some more over the weekend, and possibly sell a significant amount of UGL and buy additional DBO, turning the BDUIF into a more oil-driven fund. The use of UGL in the Fund to provide a gain on inflation really won't work unless the inflation is so severe that the resulting regulatory tightening negatively impacts the stock market -- and inflation is still uncontrolled. In other words, it works best in a stagflation economy, which probably would take months or years to develop.

I plan to provide another update in two weeks, or as conditions warrant. I leave you with an interesting chart:

Click for larger version

.

No comments:

Post a Comment